Local Government and Public Administration in Korea

OVERVIEW

Chapter 1 : Korea at a Glance

The Two Korea The Korean Peninsula lies in the middle of Northeast Asia, bordered by China to its west and Japan to its east. The peninsula is 950km long longitudinally and 540km wide latitudinally. The peninsula is surrounded by water on three sides, with flat land and mountains accounting for 30% and 70% of the entire territory, respectively. Mountains over 1,000m above sea level make up only 15% of the mountainous areas, while mountains lower than 500m account for 65%.After Japan’s defeat in 1945, the United States and the Soviet Union divided the peninsula into two zones of influence. By August 1948, the pro-U.S. Republic of Korea(South Korea) was established in Seoul, led by the strongly anti-communist Syngman Rhee. In the north, the Soviets installed Kim Il Sung as the first premier of the Democratic People’s Republic of Korea (DPRK, better known as North Korea) with its capital at Pyongyang. Defined as two different countries under international law, they joined the United Nations simultaneously.

In 1950, North Korea invaded South Korea in an effort to regain control of the entire peninsula. The United States and the United Nations troops fought alongside South Korean forces in the Korean War. At the end of the Korean War, the armistice agreement left the Korean Peninsula divided much as before, with a demilitarized zone (DMZ) running along latitude 38 degrees North, or the 38th parallel. The DMZ functions as a buffer to prevent an armed conflict between the two Koreas.

Government of South Korea South Korea has been especially successful in developing its industrial-economic potential to the point at which it is now a major player in the global economy. Among countries that were colonized in the 20th century, South Korea is one of the countries that has successfully transformed into an economically industrialized, socially developed, politically democratized, and culturally dynamic nation. The government of South Korea is composed of three independent branches: the Executive branch, the Legislative branch (the National Assembly), and the Judiciary branch.

In 1948, the first 198 members of the National Assembly had been elected in the country’s first general election held under UN supervision in South Korea. On July 17 of the same year, the first National Assembly promulgated the Constitution. Its members elected Rhee Syngman as the first President on July 20.

The country’s Constitution has adopted liberal democracy as the basic principle of governance and a Presidential system. The executive power is vested in the Executive Branch headed by the President, who is elected by the direct vote of the people for a five-year term under the Constitution. The State Council, usually referred to as the "Cabinet meeting" shall deliberate on important policies that fall within the power of the Executive.

The Judiciary of the government is composed of the Supreme Court, appellate courts, district courts, family courts, administrative courts, and the patent court among others. The Supreme Court Chief Justice is appointed by the President with the consent of the National Assembly while other Supreme Court justices are appointed by the President upon the recommendation of the Chief Justice.

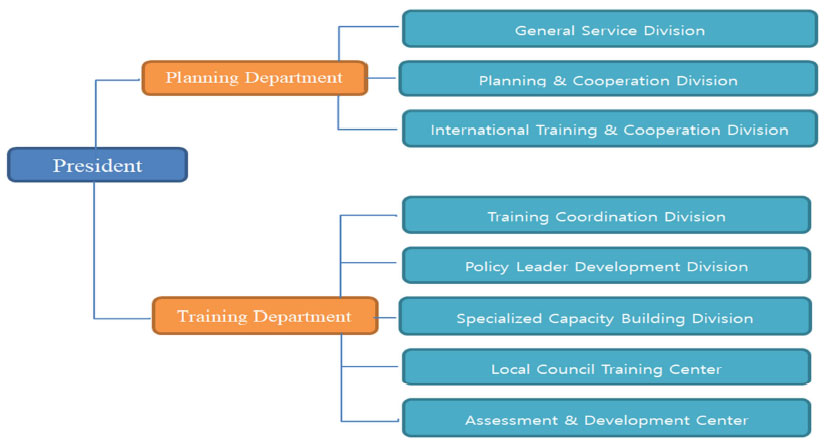

Chapter 2 : Local Government Officials Development Institute

As one of the most well-known and prestigious training centers in Korea, the Local Government Officials Development Institute (LOGODI) was established on September 1, 1965 as the Local Administration Training Institute (LATI). In January of 1999, the LATI was renamed as the National Institute of Professional Administration (NIPA), incorporating the following five training centers which were previously under other ministries. In January of 2005, the NIPA was reorganized as the current LOGODI. In 2013, LOGODI was relocated to its present location in the Wanju County of Jeonbuk Province in accordance with the government policy in order to promote balanced regional development. Since its establishment, LOGODI has been contributing to the development of local administration through strengthening the capacity of Korean and foreign local government officials. Its mission is ‘Fostering Local Government Officials Who Lead Government Innovation and Decentralization.’[Organization of LOGODI]

LOCAL GOVERNMENT

Chapter 3 : Structure of Local Government

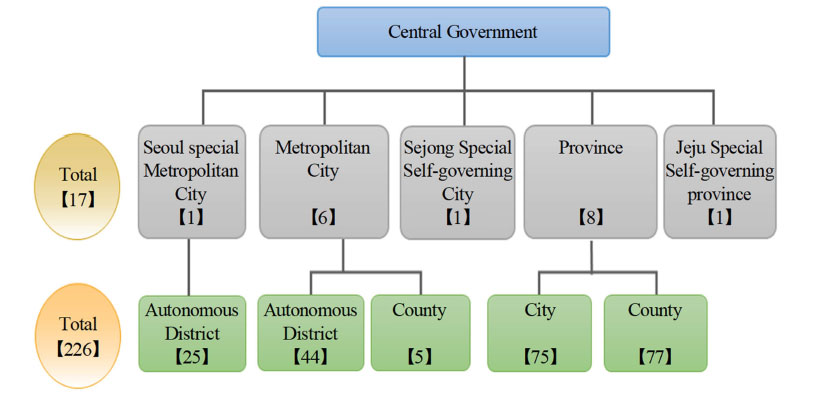

South Korea enacted the Local Autonomy Act (LAA) in 1949 and adopted the local autonomous system in June 1995.Korea has adopted a two-tier local government system. The upper-level (regional level) local governments include the provinces and the metropolitan cities. The lowerlevel(municipal level) local governments include the rural counties, cities, and districts.

There are 17 upper-level local governments and 226 lower-level local governments.

The heads of the local governments and the members of local councils are each elected for a four-year term.

[Two-tier Local Government System]

[Structure of Local Government]

Chapter 4 : Functions of Local Government

According to the Local Autonomy Act (LAA), Korean local governments enjoy power and autonomy across a broad range of government functions. Article 9 of the LAA provides local governments with two different types of functions; 1) functions that are inherently local in nature and 2) functions delegated by the central government. The Act also exemplifies six categories of local government functions as follows:- Functions related to the territorial jurisdiction, organizational and managerial aspects of local governments

- Functions to promote the general welfare of local residents

- Functions related to the promotion of industries including agriculture, forestry, trade, industry, etc.

- Functions related to regional development, construction and environmental facilities

- Functions to promote education, athletic activities, culture and art

- Functions related to civil defense and fire fighting

Chapter 5 : Local Election

In order to select representatives who run government on behalf of the citizens' interests, various election methods have been developed in many democratic countries.Among them, Korean local governments have adopted a partisan multi-member district system combined with proportional representation. The institutional scheme for local government has changed over time, and now Korean local governments have adopted a partisan multi-member district system combined with proportional representation.

Based on these institutional schemes, Korean voters choose four groups of local officials:

- Upper-level Government Executives, such as mayors of metropolitan cities and provincial governors;

- Heads of Municipal Governments;

- Councilors for Upper-level Governments; and

- Councilors for Municipal Governments.

Local government heads and local council members are elected by direct popular vote for a four-year term. The head of the local government can be reelected for up to three terms. There is no limit on how many terms a local councilor may serve.

Chapter 6 : Local Council

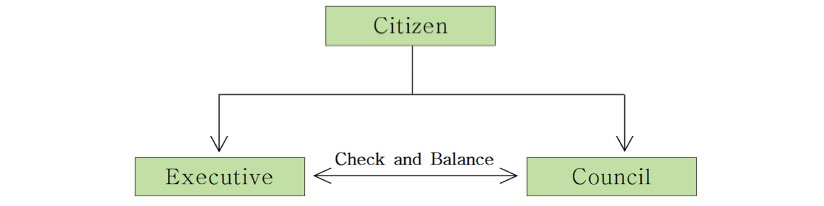

both by district and proportional ballots. Local councils engage in three principal functions: policy-making, representation, and oversight. Local councilors serve a four-year term and have no term limits.In the mayor-council form of local government, local councils compete for control of programs and policies with executives; thereby, local councils and executives are at times cooperating, at other times in confrontation, and sometimes even in gridlock.

Since the council and executive body are expected to check and balance one another, each is endowed with the proper legal authorities.

Each local council is structured with a plenary session, committee, and secretariat.

The activities of local councils mainly operate thorough plenary sessions and standing committee meetings with the support of the secretariat.

Chapter 7 : Elected Executives

Mayors of cities and counties, and governors of provinces in Korean officially represent their government. At the same time, they lead the executive branches of local governments as chief executive officers. Mayors and governors are elected by popular vote. Once elected, they serve a 4-year term, and can serve a maximum of three terms.Since the revival of local self-governments, elected executives have dominated local politics. The Local Autonomy Act (LAA) grants them substantial budgetary, appointment, and veto powers and keeps local councils feeble and fragmented under the strong mayoral form of government. Korean local governments were designed to check and balance local councils and elected executives. The list of powers of elected executives stipulated in the LAA (Representing local government, Exercising general direction and control over administrative affairs, Appointment power, Preparation and implementation of budget, Veto power).

With institutional powers and unofficial political resources, elected mayors dominate the political process of local government. In terms of educational level and professional career, they mow down their counterparts, local councilors in general. In fact, they dominate the policy-making process in local governments without serious challenge from local councils, NGOs, or any other social forces. Bureaucrats are also significant participants and their influence in the policy process at the local level has increased recently. Until major political parties decentralized nominating power of chairpersons of local chapters in 2005, elected mayors had been the most powerful figures in local politics. Since 2006, they have been under the political control of national assemblymen who hold the position of local chapter chairpersons.

Chapter 8 : Intergovernmental Relations

Local self-government is a governing system in which central and local governments share power and responsibility in governing the nation. Korean local selfgovernments were created by the central government. The central government legally authorized them as corporate bodies with a certain amount of autonomy in public services. Sharing power and responsibility between central and local governments implies that the two parties interact with each other regarding the provision of public services. These intergovernmental relations can be characterized in two aspects: conflict and cooperation.Intergovernmental relations include five different dimensions: the relationship between central and upper-level local governments, between central and lower-level local governments, between upper- and lower-level local governments, between upperlevel local governments, and between lower-level local governments.

Chapter 9 : Citizen Participation

Citizens have opportunities to participate in government in various ways other than order to open local governments to public scrutiny and to stimulate public input.Citizens can participate in the administration of local governments through various institutional mechanisms such as;

- Resident petition and initiative,

- Resident request for audit and investigation,

- Residents' lawsuit,

- Referendum, and

- Recall.

In addition, citizen participatory budgeting has been recently employed to strengthen the citizens’ control over the local government budgeting process.

The key feature shared by most of these institutional measures is that they are actions initiated by citizens. These measures have positive effects on local democracy in at least two aspects.

- First, they enable the government and the citizenry to exchange information, and thus contribute to the growing capacity of local governments.

- Secondly, they may alter resource allocations and political power patterns.

These institutional measures continue to strengthen citizen engagement and to enhance transparency of local government operations.

Chapter 10 : Budget and Accounting System

The national budget consists of the finances of the central government, the local governments, and local education.Local Government’s Finance funds. Their revenues consist of local government bonds, independent sources (local taxes and non-tax revenues) and dependent sources (local subsidies and subsidies) from the national treasury. The revenue source consists of transfers from the central government (local education subsidies and subsidies from the national treasury), transfers from higher-tier local governments (local education tax, tobacco consumption tax, and city & province taxes), and independent revenue sources (tuition and admission fees).

Korean local governments make important contributions to improving the welfare of local residents through beneficial projects funded by annual budgets. Mayors and local law-makers of those two branches participate in the budget process. The budgets are prepared by the executive branches and determined by the legislative branches and expected to be checked and balanced. As both are politicians who pursue votes in the election, however, they sometimes vote for their own pet projects neglecting the interests of the general public.

Local Education In accordance with the Principle of Autonomy of Education under the Local Education Government Act, local education is financed by the special account for educational expenses separated from general local finance. Each city and provincial office of education relies on the special account for educational expenses to support infant, elementary, and secondary education as it sees fit. Expenditure is divided by nature into personnel costs for school teachers and other staff, assistance towards educational projects, and acquisition cost.

Local Finance Equalization Scheme Korea's Local Finance Equalization Scheme allows the central government or higher tier local governments to transfer financial resources to local governments with weak revenue base. It has been established 1) to divide the roles and responsibilities among the central and local governments in an efficient manner, 2) help supply public goods in adequate quantities by addressing the externalities among regions, and 3) redress disparities in fiscal strength among local governments. The current Local Finance Equalization Scheme consists of the transfer of resources between the central and local governments and transfers between metropolitan units and basic units of local governments. The fiscal adjustment system between the central and local governments deals with resource allocation (local subsidy and local education subsidy) and subsidy from the national treasury. The system between local governments of metropolitan units and basic units deals with subsidies for cities and provinces, adjusted resource allocation, and financial coverage.

Taxes The 1988 Local Finance Act, which determines Local financing, has been amended several times in 2005, 2009 and 2011, in order to increase fiscal decentralization and reform the tax and grants systems. The current structure of the Korean local tax system favors urban areas. Expanding local taxes would make this situation worse by further increasing the revenue capacity of the urban areas at the expense of rural areas. This would call for a review of the equalization mechanisms.

Most tax rates are determined by the central government. Provincial taxes comprise ordinary taxes (acquisition tax, registration and license, leisure, and local consumption taxes) and earmarked taxes (community resource and facility and local education taxes).

City and county taxes include ordinary taxes such as inhabitant, property, automobile, local income, and tobacco consumption taxes. Metropolitan cities can levy both provincial and municipal own taxes.

Local Subsidy The central government provides local governments with subsidies composed of internal taxes and comprehensive real estate taxes. Currently local subsidies consist of general subsidies, special subsidies, decentralization subsidies, and real estate subsidies. General subsidies guarantee fiscal resource necessary for the maintenance of administrative activities of local governments to a certain degree. From 2015, the decentralization subsidy will be included as a part of the general subsidy. The real-estate subsidy receives its resources from the total amount of Comprehensive Real Estate Tax. And, it is distributed in accordance with the fiscal condition of each local government.

Subsidy from the National Treasury Subsidies from the national treasury for local governments are designed to subsidize parts or all of the costs related to projects commissioned by the state. These are granted by the state. These are distinguished from local taxes or non-tax revenues (independent which are used as general financial resources of local governments. In that said, these have specific predetermined purposes.

Other Revenues Other revenues include mainly user charges and fees (8% of revenue). Revenue from property (sales of assets, leasing, dividends, etc.) accounts for less than 1% of local government revenue

Local Fiscal Crisis Alert System According to the Local Autonomy Act, local governments must maintain a balanced budget. Performance-based budgeting was also introduced for local governments in 2016. A Local Fiscal Crisis Alert System was introduced in 2012 to prevent local governments from being in fiscal insolvency or moratorium, which monitors seven local fiscal statuses which may be connected directly to fiscal crisis.

Source : LOGODI